ANNUAL MEETINGOF SHAREHOLDERS

Proxy Statement

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x☒

Filed by a Party other than the Registrant☐o

Check the appropriate box:

x Preliminary Proxy Statement

o Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

FOOT LOCKER, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

(1) | Title of each class of securities to which transaction applies: | |

|

|

|

| ||

(2) | Aggregate number of securities to which transaction applies: | |

|

|

|

| ||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

|

| ||

(4) | Proposed maximum aggregate value of transaction: | |

|

|

|

| ||

(5) | Total fee paid: | |

|

|

|

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

(1) | Amount Previously Paid: | |

|

|

|

| ||

(2) | Form, Schedule or Registration Statement No.: | |

|

|

|

| ||

(3) | Filing Party: | |

|

|

|

| ||

(4) | Date Filed: | |

|

|

|

ANNUAL MEETINGOF SHAREHOLDERS

Proxy Statement

330 West 34th Street

New York, New York 10001

Chairman’s Letter to our Shareholders

April 7, 201712, 2019

Dear Fellow Shareholders:

Last year, I highlighted how our customers’ rapidly-changing preferences and shopping behaviors–fueled by access to information, influences, and ideas from around the world–were challenging for our Company and the broader retail industry. This year, I am pleased to invite youreport that, by focusing on our commitment to elevate the customer experience across each of our channels and leveraging our strategic brand partnerships, we continued to differentiate our business and build positive momentum through each quarter of 2018. In 2019, we will continue to build on our strengths and seize opportunities to evolve our business by developing our internal assets and expanding into new markets.

Everything we do starts with the customer. Our new strategic framework is built on knowing, engaging, and serving our customers–wherever and however they want to interact with us–in store or online. By executing against this framework, we believe we will have the focus and tools to achieve our four key strategic imperatives:

|  |  |  |

| elevate the customer experience | invest for long-term growth | drive productivity | leverage the power of our people |

Sales Mid-Single Digit Compounded Annual Growth Rate | Sales per Gross Square Foot $525 - $575 | Earnings Before Interest and Taxes Margin Low Double-Digits* | Net Income Margin High-Single Digit | Return on Invested Capital Mid-Teens | Inventory Turnover 3-4 Times* |

| * | Because these non-GAAP measures are uncertain, these amounts have not been reconciled to GAAP. |

Welcome to the Foot Locker, Inc.’s 2019 Annual Meeting of Shareholders

| ○ | Carbon38 – a destination for women’s luxury activewear |

| ○ | GOAT Group – a managed marketplace for customers to buy and sell authentic sneakers |

| ○ | PENSOLE – a footwear design academy that, together with us and our vendor partners, will collaborate on new educational programs and the design and manufacture of exclusive products |

| ○ | Rockets of Awesome – a children’s direct-to-customer apparel company |

| ○ | Super Heroic – a lifestyle brand that designs, manufactures, and markets children’s footwear, clothing, and accessories |

|  |  |  |

| Opportunity | Community | Worker Dignity | Sustainability |

We continuously look for new and better ways to foster a diverse and inclusive work environment, engage our surrounding communities, improve employee safety, and minimize our environmental impact, all while creating value for our shareholders.

The Notice of 2019 Annual Meeting of Shareholders and Proxy Statement contain details of the business to be conducted at 125the 2019 Annual Meeting.

Your vote is very important to us, so regardless of whether you attend the meeting, please vote your shares.

This is an exciting time for Foot Locker, Inc. We are proud of what we accomplished in 2018, but we are just getting started on our new journey toinspire and empower youth culture. By focusing on our strategic imperatives, leveraging our global presence, and putting the customer at the center of everything we do, we believe we will build upon last year’s momentum and deliver against our updated long-term goals. I look forward to sharing our success with each of you at the 2019 Annual Meeting.

Sincerely,

| Richard A. Johnson Chairman, President and Chief Executive Officer |

330 West 33rd34th Street

New York, New York 10001 at 9:00 a.m., Eastern Daylight Time.

You are being asked to vote on the following proposals at the Annual Meeting:

|  |  |

| Date and Time | Location | Record Date |

May 22, 2019 at 9:00 a.m., Eastern Daylight Time (“EDT”) | NYC33, 125 West 33rd Street, ► (see page 76 for directions | Shareholders of record as of March 25, 2019 can vote at this meeting |

Items of Business

| Proposal | Board’s Voting Recommendation | |

| Elect | ✓ FOReach nominee |

| Approve, on an advisory basis, our named executive officers’ (“NEOs”) compensation | ✓ FOR |

| Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the | |

If you plan to attendTransact such other business as may properly come before the meeting please see Page 91 for admission requirements. Regardlessand at any adjournment or postponement of whether you attend the meeting your vote is important to us, so please vote your shares. For instructions on how to vote, please see Page 90 of this Proxy Statement.

ThankProxy Voting

You may vote using any of the following methods:

Telephone

| If you are located within the United States or Canada, you may vote your shares by calling 800-690-6903 and following the recorded instructions. Telephone voting is available 24 hours a day and will be accessible until 11:59 p.m. EDT on May 21, 2019. The telephone voting system has easy to follow instructions and allows you to confirm that the system has properly recorded your vote. If you vote by telephone, you do NOT need to return a proxy card or voting instruction form. | |

Scanning

| You may scan the QR Code provided to you to vote your shares through the internet with your mobile device. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. EDT on May 21, 2019. You will be able to confirm that the system has properly recorded your vote. If you scan your QR code to vote, you do NOT need to return a proxy card or voting instruction form. | |

Ballot

| You may vote by ballot at the Annual Meeting if you decide to attend in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the meeting. If you plan to vote by ballot at the Annual Meeting, you do NOT need to return a proxy card or voting instruction form. | |

Internet

| You may vote your shares through the internet atproxyvote.com. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. EDT on May 21, 2019. As with telephone voting, you will be able to confirm that the system has properly recorded your vote. If you vote via the internet, you do NOT need to return a proxy card or voting instruction form. | |

| If you received printed copies of the proxy materials by mail, you may vote by mail. Simply mark your proxy card or voting instruction form, date and sign it, and return it in the postage-paid envelope that we included with your materials. |

All shares that have been properly voted and not revoked will be voted at the Annual Meeting. If you for beingsign and return a shareholder and forproxy card but do not give voting instructions, the trust you have in Foot Locker, Inc.shares represented by that proxy card will be voted as recommended by the Board.

Sincerely,Your vote is very important to us. Please exercise your right to vote.

Richard A. Johnson

Chairman and Chief Executive Officer

330 West 34th StreetNew York, New York 10001

Important Notice Regarding the Availability of 2017Proxy Materials for the Annual Meeting of Shareholders to be Held on May 22, 2019

The Company’s Proxy Statement and 2018 Annual Report on Form 10-K are available atmaterials.proxyvote.com/344849.

April 12, 2019

Sheilagh M. Clarke

Senior Vice President,

General Counsel and Secretary

Proxies are being solicited by the Board of Directors of Foot Locker, Inc. (NYSE: FL) (“Foot Locker,” the “Company,” “we,” “our,” or “us”) to be voted at our 2019 Annual Meeting. As this is a summary of our Proxy Statement, please refer to the complete Proxy Statement for more complete information.

2019 Annual Meeting of Shareholders

| Date and Time: | Proposal | Board’s Voting Recommendation | Page | ||

May 22, 2019 at 9:00 a.m. EDT Location: NYC33, 125 West 33rd Street, Record Date: March 25, 2019 |  | Elect ten members to the Board to serve for one-year terms | ✓FOReach nominee | 1 | |

| Approve, on an advisory basis, our NEOs’ compensation | ✓FOR | 32 | ||

| Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the | ✓FOR | 69 | ||

On or about April 12, 2019, we started mailing a Notice Regarding the Internet Availability of Proxy Materials to our shareholders.

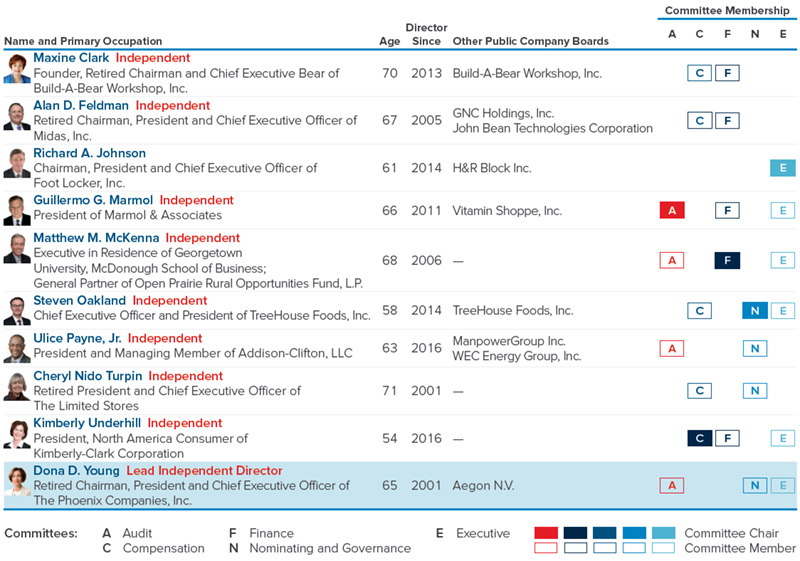

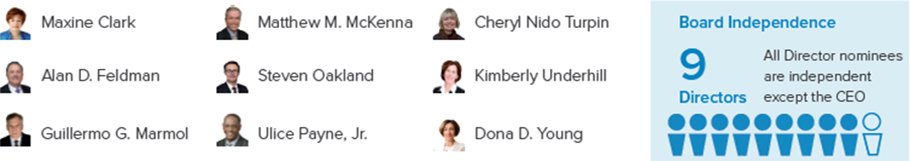

Director Nominees

Ten directors are standing for election at the 2019 Annual Meeting for one-year terms. The table below provides summary information about each of the nominees for director. See pages 6 through 12 for additional information about each nominee and pages 25 through 27 for additional information about the Committees of the Board.

| 2019 Proxy Statement |  1 |

Proxy Statement Summary

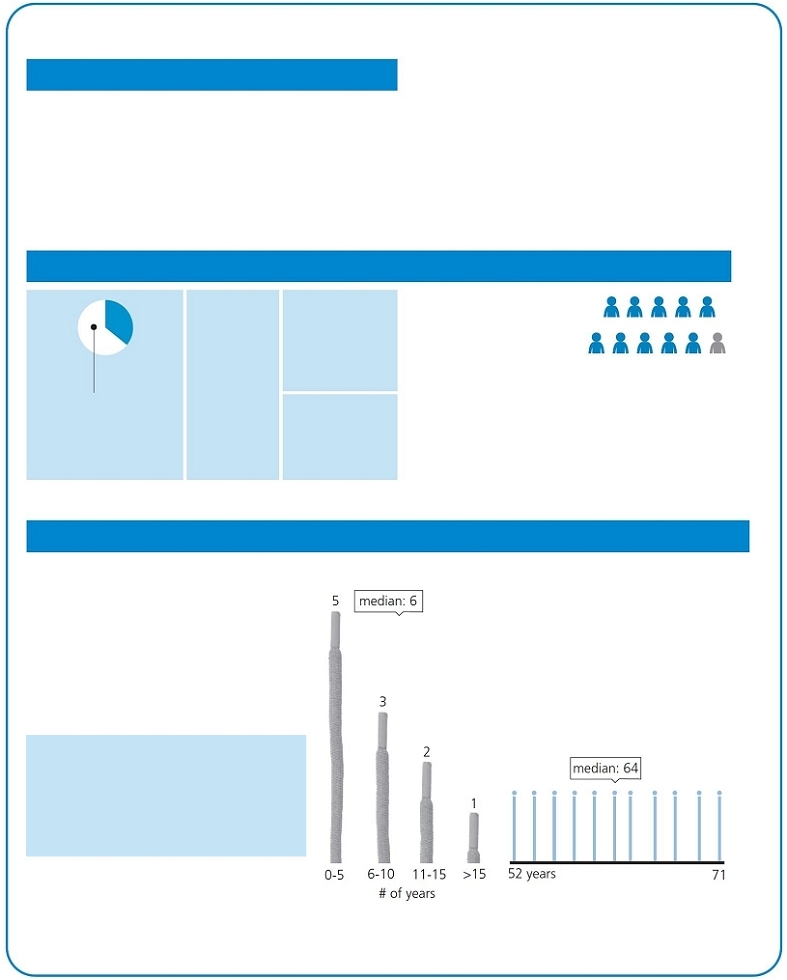

Board Snapshot

Attendance

Over97%Attendance of Directors

at Board and Committee Meetings in 2018

Independence

9out of10directors are independent

All directors are independent, except the CEO

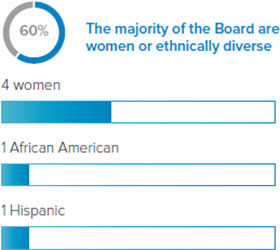

Diversity

Our directors represent a range of backgrounds and experience. The majority are women or ethnically diverse. Our Nominating and Corporate Governance Committee (the “Nominating and Governance Committee”) is focused on ensuring continued diversity on the Board—in terms of gender, age, ethnicity, skills, business experience, service on our Board and the boards of other organizations, and viewpoints—during refreshment activities by requiring that candidate pools include diverse individuals meeting the recruitment criteria.

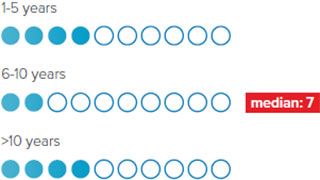

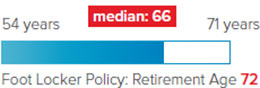

Tenure

Directors with varied tenure contribute to a range of perspectives and ensure we transition knowledge and experience from longer-serving members to those newer to our Board. We have a good mix of new and longer-serving directors.

Refreshment

3 New Directors Added Over Past Five Years

3 Directors Retired Over Past Five Years

Age

2 | Foot Locker, Inc. |

Proxy Statement Summary

Environmental, Social, and Governance Highlights

The Company and the Board are focused on corporate social responsibility. We continuously look for new and better ways to foster a diverse and inclusive work environment, engage our surrounding communities, improve employee safety, and minimize our environmental impact, all while creating value for our shareholders. Below are some recent highlights of our diversity and sustainability initiatives.

| ||||||

April 7, 2017

Important Notice Regarding the Availability of Proxy Materials forthe Annual Meeting of Shareholders to be Held on May 17, 2017

The Company’s Proxy Statement and 2016 Annual Report on Form 10-K are available athttp://materials.proxyvote.com/344849.

Table of Contents

| |

|

|

2017 Annual Meeting of Shareholders

| ||||||||

|  | |||||||

| ● | We have several women in senior leadership roles, including the Chief Financial Officer, Chief Human Resources Officer, General Counsel and Secretary, Chief Accounting Officer, Vice President—Global Total Rewards, and Vice President and General Manager, Foot Locker Pacific | ● | Our independent directors represent a diverse range of backgrounds and experience | |||||

| ● | We strive to have a workforce that reflects the | |||||||

| ||||||||

| ● | Raised and donated over$9 millionfor scholarships since 2004, plus footwear and apparel donations to | ● | U.S. non-store employees permitted paid time-off for volunteering in | |||||

| ||||||||

| Global Sourcing Guidelines (GSG) are distributed annually to | ||||||||

| ||||||||

| Reduced energy (including the replacement of | ||||||||

On or about April 7, 2017, we started mailing to most of our shareholders in the United States a Notice Regarding the Availability of Proxy Materials.

|

|

Director Nominees

Eleven directors are standing for election at this meeting for one-year terms. Mr. DiPaolo will be retiring from the Board when his term expires at the conclusion of the 2017 Annual Meeting in accordance with the retirement policy for directors. The table below provides summary information about each of the nominees for director. Please see Pages 3 through 9 for additional information about each nominee and Pages 18 through 20 for additional information about the Committees of the Board.

| Committee Membership** | ||||||||||||||||||

| Name and Primary Occupation | Age* | Director Since | Independent | Other Public Company Boards | Audit | Finance | Compensation | Nominating | Executive | |||||||||

| Maxine Clark | ||||||||||||||||||

| Founder, Retired Chairman and Chief Executive Bear of Build-A-Bear Workshop, Inc. | 68 | 2013 |  | Build-A-Bear Workshop, Inc. Gymboree Corp. | l | l | ||||||||||||

| Alan D. Feldman | ||||||||||||||||||

| Retired Chairman, President and Chief Executive Officer of Midas, Inc. | 65 | 2005 |  | GNC Holdings, Inc. John Bean Technologies Corporation | l |  | l | |||||||||||

| Jarobin Gilbert, Jr. | ||||||||||||||||||

| President and Chief Executive Officer of DBSS Group, Inc. | 71 | 1981 |  | None | l | l | ||||||||||||

| Richard A. Johnson | ||||||||||||||||||

| Chairman, President and Chief Executive Officer of Foot Locker, Inc. | 59 | 2014 |  | H&R Block Inc. |  | |||||||||||||

| Guillermo G. Marmol | ||||||||||||||||||

| President of Marmol & Associates | 64 | 2011 |  | Vitamin Shoppe, Inc. |  | l | l | |||||||||||

| Matthew M. McKenna | ||||||||||||||||||

| Executive in Residence of Georgetown University, McDonough School of Business | 66 | 2006 |  | None | l |  | l | |||||||||||

|  |

| Committee Membership** | ||||||||||||||||||

| Name and Primary Occupation | Age* | Director Since | Independent | Other Public Company Boards | Audit | Finance | Compensation | Nominating | Executive | |||||||||

| Steven Oakland | ||||||||||||||||||

| Vice Chair and President, U.S. Food and Beverage of The J.M. Smucker Company | 56 | 2014 |  | None | l |  | l | |||||||||||

| Ulice Payne, Jr. | ||||||||||||||||||

| President and Managing Member of Addison-Clifton, LLC | 61 | 2016 |  | ManpowerGroup Inc. The Northwestern Mutual Life Insurance Company WEC Energy Group, Inc. | l | l | ||||||||||||

| Cheryl Nido Turpin | ||||||||||||||||||

| Retired President and Chief Executive Officer of the Limited Stores | 69 | 2001 |  | None | l | l | ||||||||||||

| Kimberly Underhill | ||||||||||||||||||

| Global President of Kimberly-Clark Professional | 52 | 2016 |  | None | l | l | ||||||||||||

| Dona D. Young | ||||||||||||||||||

| Retired Chairman, President and Chief Executive Officer of The Phoenix Companies, Inc. | 63 | 2001 |  | Aegon N.V. | l | l | l | |||||||||||

| ||

|

|

Board Attendance

2016

99%

Attendance of Directorsat Board and CommitteeMeetings in 2016

Board Composition*

All directors areindependent,except the CEO(10 out of 11 directorsare independent)

Board Refreshment*

Foot Locker Policy: Retirement age 72

* As of May 17, 2017.

|  |

Named Executive Officers

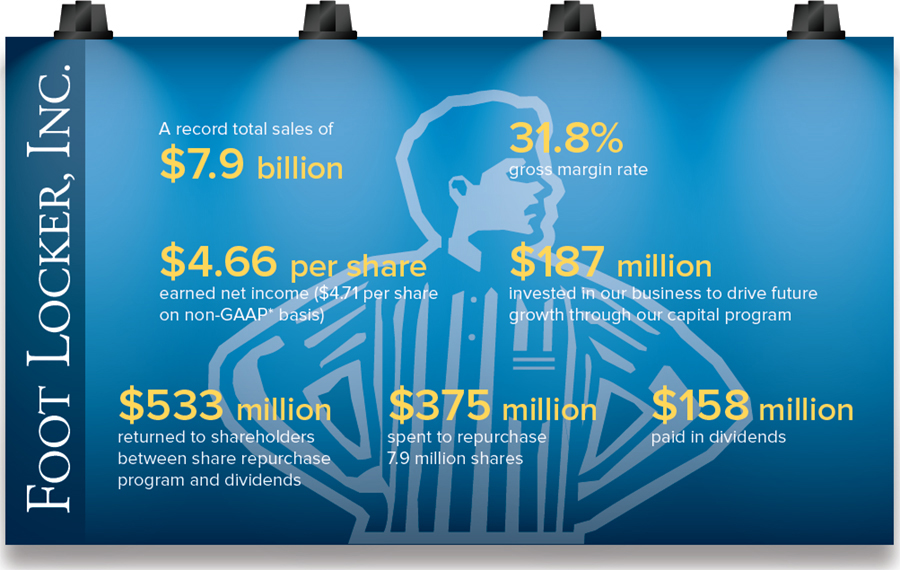

Fiscal 2016 Results

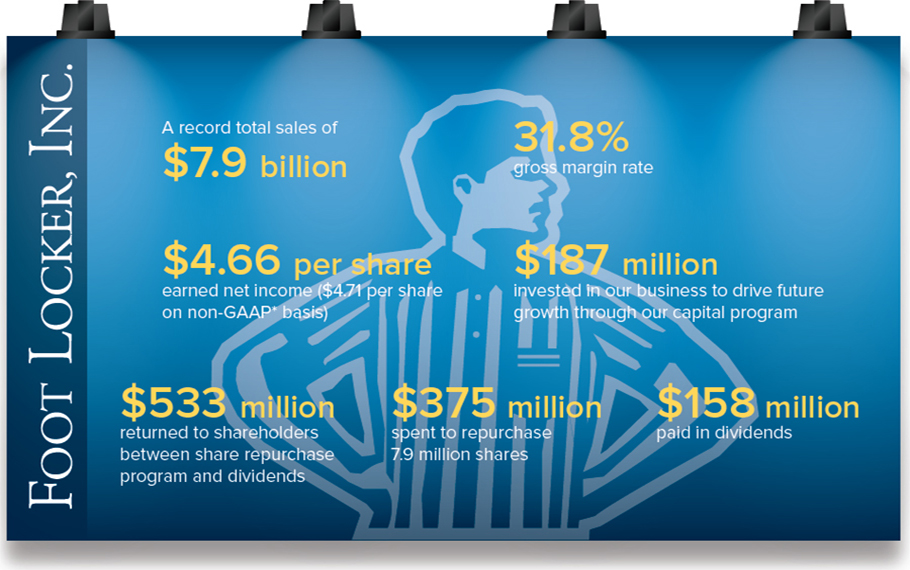

Our 2016 fiscal year was a very strong year for Foot Locker. The power and relevance of our strategic initiatives, as well as our team’s outstanding execution of them, can be seen in the financial success we achieved in 2016, as shown in this brief list of highlights:

*A reconciliation to GAAP is provided on Pages 16 through 18 U.S. workforce represents 74% of our 2016 Annual Report on Form 10-K.global workforce.

|

|

Proxy Statement Summary

Recognition

For additional information, seeEnvironmental, Social, and Governance Highlightsbeginning on page 20.

Fiscal 2018 Results

We built positive momentum and improved our financial results in 2018. Highlights include the following:

| * | A reconciliation to GAAP is provided beginning on page 16 of our 2018 Annual Report on Form 10-K. |

4 | Foot Locker, Inc. |

Proposal 1: Election of Directors

ThereThere are currently 1210 directors on our Board. Nicholas DiPaolo will be retiring when his term expires at the conclusion of this Annual Meeting, and theThe Board has fixed the number of directors at 11 effective at such time. At our 2014 Annual Meeting, shareholders approved a proposal to declassify the Board beginning in 2015. Consequently, this year all10. All current directors other than Mr. DiPaolo are standing for election for a one-year term at this meeting.

We have refreshed our Board over the past sixfive years, as seventhree highly-qualified directors were added to the Board and fivethree directors will have retired as of the Annual Meeting.retired. We believe that the Board possesses the appropriate mix of diversity in terms of gender, age, ethnicity, skills, business experience, service on our Board and the boards of other organizations, and viewpoints.

Our Nominating and Corporate Governance Committee (the “Nominating Committee”) is responsible for recommending director candidates to fill current and anticipated Board vacancies. The Nominating Committee identifies and evaluates potential candidates from recommendations from the Company’s directors, management, shareholders, and other outside sources, including professional search firms. In evaluating proposed candidates, the Nominating Committee may review their résumés, obtain references, and conduct personal interviews. The Nominating Committee considers, among other factors, the Board’s current and future needs for specific skills and the candidate’s experience, leadership qualities, integrity, diversity, ability to exercise judgment, independence, and ability to make the appropriate time commitment to the Board. The Nominating Committee strives to ensure the Board has a rich mix of relevant skills and experiences to address the Company’s needs by our strategic plan.

During 2016, the Nominating Committee conducted a director search for potential director candidates whose experience, skills, qualifications, and independence met the criteria it previously established, and the Nominating Committee reviewed its findings with the Board. In conducting its search, the Nominating Committee collected names of potential candidates from existing Foot Locker directors and engaged SpencerStuart, a third-party search firm, to identify and recruit qualified candidates. After reviewing the qualifications of the potential pool of candidates and narrowing the field to a handful of candidates, our Chairman and our Lead Director interviewed the candidates. Based on the Nominating Committee’s review, the candidates’ résumés, and director interviews with the candidates, the Nominating Committee recommended and the Board approved the nomination of Ulice Payne, Jr. and Kimberly Underhill, each of whom was identified by SpencerStuart.

Maxine Clark, Alan D. Feldman, Jarobin Gilbert, Jr., Richard A. Johnson, Guillermo G. Marmol, Matthew M. McKenna, Steven Oakland, Ulice Payne, Jr., Cheryl Nido Turpin, Kimberly Underhill, and Dona D. Young will be considered for election as directors to serve for one-year terms expiring at the 20182020 Annual Meeting. Each nominee has been nominated by the Board for election and has consented to serve. Ms. Clark, Mr. Feldman, Mr. Gilbert, Mr. Johnson, Mr. Marmol, and Mrs. Young were elected to serve for their present terms at the 2016 Annual Meeting; Mr. McKenna, Mr. Oakland, and Ms. Turpin were elected to serve for their present terms at the 2014 Annual Meeting; and Mr. Payne and Ms. Underhill were elected by the Board on November 16, 2016 to serve for their present terms, effective December 1, 2016. If, prior to the 20172019 Annual Meeting, any nominee is unable to serve, then the persons designated as proxies for this meeting (Sheilagh M. Clarke, John A. Maurer, and Lauren B. Peters) will have full discretion to vote for another person to serve as a director in place of that nominee.nominee or the Board may reduce the size of the Board.

|

|

Proposal 1

The Nominating and Governance Committee reviewed and updated the director skill setskill-set matrix in light of the Company’s 2015-20 long-term strategic plan and evaluated each of the directors’ skills, experience, and qualifications under the updated matrix, which is shown beginning on Page 9.

page 11.

The Board, acting through the Nominating and Governance Committee, considers its members, including those directors being nominated for reelection to the Board at the 20172019 Annual Meeting, to be highly qualified for service on the Board due to a variety of factors reflected in each director’s education, areas of expertise, and experience serving on the boards of directors of other organizations during the past five years. Generally, the Board seeks individuals with broad-based experience and who have the background, judgment, independence, and integrity to represent the shareholders in overseeing the Company’s management in their operation of the business, rather than specific, niche areas of expertise.business. Within this framework, specific items relevant to the Board’s determination for each director are listed in each director’s biographical information beginning on Page 3.page 6. The ages shown are as of April 7, 2017.12, 2019. There are no family relationships among our directors or executive officers.

The Board recommends that shareholders voteFORthe election of each of theeleven identified nominees to the Board.

| ✓ | The Board recommends that shareholders voteFOR the election of each of the ten identified nominees to the Board. |

| 2019 Proxy Statement |

|

Proposal 1: Election of Directors

| Maxine Clark | |  |

|

Proposal 1

Independent Director Age: Director since:2013

|

| |

| Ms. Clark served as Chief Executive Bear of Build-A-Bear Workshop, Inc.

| Ms. Clark has extensive experience in both domestic and international retailing, including founding and leading Build-A-Bear Workshop, serving as President of Payless ShoeSource, Inc., and serving for 19 years as an executive of The May Department Stores Company. She adds significant experience to our Board in strategic planning, real estate, digital technology, and marketing. Her retail and business background, as well as her financial expertise, are particularly useful for her service as a member of the Finance and Strategic Planning Committee (the “Finance Committee”). | |

Alan D. Feldman

| ||

| Independent Director Age: Director since:2005

|

|

| Mr. Feldman served as Chairman, President and Chief Executive Officer of Midas, Inc. (automotive repair and maintenance services) from May 2006 to April 2012, and as President and Chief Executive Officer of Midas, Inc. from January 2003 to April 2006. He was an independent consultant from March 2002 to January 2003. Mr. Feldman previously served as an executive at PepsiCo, Inc., Pizza Hut, Inc., and McDonald’s Corporation. Mr. Feldman is a director of John Bean Technologies Corporation and GNC Holdings, Inc.

| Mr. Feldman is a recognized business leader with a broad base of experience in | |

| |

|

6 | Foot Locker, Inc. |

Proposal 11: Election of Directors

| Richard A. Johnson | ||

|

Age: Director since: 2014 |

|

| ||

| Mr. Johnson has served as the Company’s Chairman of the Board since May 2016, and President and Chief Executive Officer since December 2014. Mr. Johnson served as Executive Vice President and Chief Operating Officer from May 2012 to November 2014. He served as Executive Vice President and Group

| Mr. Johnson has extensive experience as a retail company executive, including | |

|  |

Proposal 1

Guillermo G. Marmol

| ||

| Independent Director Age: Director since:2011 |

|

| Mr. Marmol has served as President of Marmol & Associates (consulting firm that provides advisory services and investment capital to early stage technology companies) since March 2007 and, prior to that, from October 2000 to May 2003. He served as Division Vice President and a member of the Executive Committee of Electronic Data Systems Corporation (global technology services company) from June 2003 to February 2007, and as a director and Chief Executive Officer of Luminant Worldwide Corporation (internet professional services company) from July 1998 to September 2000. He served as Vice President and Chair of the Operating Committee of Perot Systems Corporation (information technology and business solutions company) from December 1995 to June 1998. He began his career at McKinsey & Company (management consulting firm) from 1990 to 1995, rising to Senior Partner, and was a leader of the organization and business process redesign practices. Mr. Marmol is a director of Vitamin Shoppe, Inc.

Principal Solar Inc. | Mr. Marmol has a significant background in information technology and systems, which continues to be highly important to the Company as we enhance our technology and systems and build a more powerful digital business to connect with our customers. He also serves as a director and Chair of the Nomination and Governance Committee of another public company,Vitamin Shoppe, Inc. Through his long tenure as a management consultant focusing on strategic analysis and business processes, he brings valuable knowledge and expertise to his service on the Board, | |

|

| 2019 Proxy Statement |  7 |

Proposal 1: Election of Directors

Matthew M. McKenna

| ||

| Independent Director Age: Director since:2006 |

|

| Mr. McKenna has served as Executive in Residence of Georgetown University’s McDonough School of Business since February

| Mr. McKenna has extensive | |

|

|

|

Proposal 1

Independent Director Age: Director since:2014 |

| |

| Mr. Oakland has served as Chief Executive Officer and President of TreeHouse Foods, Inc. (manufacturer of packaged foods and beverages) since March 2018. He previously served as Vice Chair and President, U.S. Food and Beverage of The J.M. Smucker Company (“Smucker’s”) (manufacturer of

Foster Farms, a privately-held poultry business. | Mr. Oakland brings to our Board a broad-based business background and extensive experience in domestic and international consumer products operations, with particular strength in customer engagement, marketing, brand-building, and strategic planning. Additionally, Mr. Oakland is actively involved in management resources issues and governance matters as | |

|

8 | Foot Locker, Inc. |

Ulice Payne, Jr. | ||

|

Independent Director Age: Director since:2016

|

|

| Mr. Payne has served as President and Managing Member of Addison-Clifton, LLC (global trade compliance advisory services provider) since May 2004. He previously served as

The Marcus Corporation from 1996 to 2000. | Mr. Payne brings to our Board significant managerial, operational, financial, public service, and global experience as a result of the many senior positions he has held, including as President and Managing Member of Addison-Clifton, LLC, President and Chief Executive Officer of the Milwaukee Brewers Baseball Club, | |

|  |

Proposal 1

Cheryl Nido Turpin

| ||

| Independent Director Age: Director since: |

|

| Ms. Turpin served as President and Chief Executive Officer of

| Ms. Turpin brings to our Board long experience as a retail executive, most recently as President and Chief Executive Officer of The Limited Stores, where she worked in a multi-divisional retail structure similar to | |

|

| 2019 Proxy Statement |  9 |

Proposal 1: Election of Directors

Kimberly Underhill | ||

|

Independent Director Age: Director since:2016

|

|

| Ms. Underhill has served as

consumer goods industries). | Ms. Underhill brings to our Board a broad-based business background and extensive experience in domestic and international consumer products operations, with particular strength in marketing, brand-building, strategic planning, and international business development. Additionally, Ms. Underhill is actively involved in management resources issues as a senior executive of a public company, which provides relevant expertise to both our Compensation Committee, of which she is Chair, and Finance Committee, of which she is a member. Through her senior executive position at Kimberly-Clark, Ms. Underhill also has significant international and business development experience. | |

|

|

Proposal 1

Dona D. Young | ||

|

Independent Lead Director Age: Director since:2001

|

|

| Mrs. Young retired in April 2009 as Chairman, President and Chief Executive Officer of The Phoenix Companies, Inc. (at the time an insurance and asset management company) after a nearly 30-year career. She currently engages in independent strategic advising and consulting, with a focus on corporate social responsibility and board governance

| Mrs. Young brings significant financial, | |

|

| |  |

Proposal 11: Election of Directors

Summary of Director Qualifications and Experience and Demographic Matrix

|  |  |  |  |  |  |  | ||||||||||||||||||||

|  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||

|  |  | |||||||||||||||||||||||||

| |||||||||||||||||||||||||||

|  |  |  |  |  | ||||||||||||||||||||||

|  |  |  |  |  |  | |||||||||||||||||||||

|  |  |  |  |  |  |  |  |  | ||||||||||||||||||

|  |  |  | ||||||||||||||||||||||||

|  | ||||||||||||||||||||||||||

|  |  |  |  |  |  |  |  | |||||||||||||||||||

|  |  |  |  |  |  |  |  |  |  | |||||||||||||||||

|  |  |  |  |  |  |

|

|

The Board is committed to good corporate governance and has adopted Corporate Governance Guidelines and other policies and practices to guide the Board and senior management.

We believe that the Boardour slate of director nominees possesses the appropriate mix of diversity in terms of gender, age, ethnicity, skills, business experience, service on our Board and the boards of other organizations, and viewpoints. We have refreshed our Board over the past sixfive years, as seventhree highly-qualified directors were added to the Board, and fivethree directors will have retired asretired. Each director is individually qualified to make unique and substantial contributions. Collectively, our directors’ diverse viewpoints and independent-mindedness enhance the quality and effectiveness of this Annual Meeting.Board deliberations and decision making. This blend of qualifications, attributes, and tenure results in highly effective leadership and is summarized below.

| Knowledge, Skills, and Experience | Clark | Feldman | Johnson | Marmol | McKenna | Oakland | Payne | Turpin | Underhill | Young | |

| Leadership | |||||||||||

| Chief Executiveexperience is important because directors who have served as CEOs of public or substantial privately-held or non-profit companies have experience working, communicating, and engaging with a variety of important stakeholder groups, including shareholders, bondholders, and investment analysts | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Strategy | |||||||||||

| Broad-Based Businessexpertise provides a depth of experience to leverage in evaluating issues, and making business judgments | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Digital and Channel Connectivityexperience is important to the Company as we build a more powerful digital experience for our customers | ● | ● | ● | |||||||

| Public Serviceexperience is relevant to the Company as it is affected by government actions | ● | ● | ||||||||

| Information Securityexperience is relevant given the importance of protecting both the Company’s and our customers’ information | ● | ● | ||||||||

| Internationalexperience is important in understanding and reviewing our business and strategy outside of the United States, particularly in Europe and Asia | ● | ● | ● | ● | ● | ● | ||||

| Retail, Brand Marketing, and Social Mediaexperience gives directors an understanding of assessing, developing, and implementing our marketing and customer engagement strategies | ● | ● | ● | ● | ● | ● | ||||

| Strategic Investmentsexperience is important in evaluating our financial statements and investment strategy | ● | ● | ● | |||||||

| Strategic Planning and Analysisexperience provides a practical understanding of assessing, developing, and implementing the metrics of our long-term financial objectives and strategic priorities | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Supply Chainexperience is important to understand the omnichannel commerce distribution model with multiple fulfilment points to serve the customer | ● | ● | ● | |||||||

| 2019 Proxy Statement |  11 |

Proposal 1: Election of Directors

| Knowledge, Skills, and Experience | Clark | Feldman | Johnson | Marmol | McKenna | Oakland | Payne | Turpin | Underhill | Young | |

| Technology and Systemsexperience is important given the importance of technology to the retail marketplace, our internal operations, and our customer engagement initiatives | ● | ● | ||||||||

| Youth Culture/Target Marketexperience is important to understand our business and strategy as our brands keenly focus on their target customers, particularly youth culture | ● | ● | ● | ● | ||||||

| Governance | |||||||||||

| Accounting or Financialexpertise gained from experience as a CEO, audit professional, or finance executive is important because it assists our directors in understanding and overseeing our financial reporting and internal controls | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Business Development / Mergers and Acquisitionsexperience is important because it helps in assessing potential growth opportunities | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Environmental, Social, and Governanceexperience is important because it supports our goals of strong Board and management accountability, transparency, and protection of shareholder interests | ● | ● | ● | ● | ● | ● | ● | |||

| Risk Managementexperience is helpful to the Board’s role in overseeing the risks facing the Company | ● | ● | ● | ● | ● | ● | ||||

| Demographic Background | |||||||||||

| Board Tenure (Year Joined) | 2013 | 2005 | 2014 | 2011 | 2006 | 2014 | 2016 | 2001 | 2016 | 2001 | |

| Years | 6 | 14 | 5 | 8 | 13 | 5 | 3 | 18 | 3 | 18 | |

| Gender | ● | ● | ● | ● | ● | ● | |||||

| Male | ● | ● | ● | ● | |||||||

| Female | |||||||||||

| Age (at April 12, 2019) | |||||||||||

| Years old | 70 | 67 | 61 | 66 | 68 | 58 | 63 | 71 | 54 | 65 | |

| Race/Ethnicity | |||||||||||

| African American | ● | ||||||||||

| Hispanic | ● | ||||||||||

| White | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Number of Other Public Company Boards | 1 | 2 | 1 | 1 | — | 1 | 2 | — | — | 1 | |

12 | Foot Locker, Inc. |

Corporate Governance Guidelines

The Board is committed to good corporate governance and has adopted Corporate Governance Guidelines.Guidelines and other policies and practices to guide the Board and senior management.

Our By-Laws provide for a Board consisting of between 7 and 13 directors. The exact number of directors is determined from time to time by the entire Board. The Board periodically reviewshas fixed the guidelinesnumber of directors at 10, and revises them, as appropriate. Thethere are currently 10 directors on our Board.

Directors’ Independence

A director is not considered independent under New York Stock Exchange (“NYSE”) rules if he or she has a material relationship with the Company that would impair his or her independence. In addition to the independence criteria established by the NYSE, the Board has adopted categorical standards to assist it in making its independence determinations regarding individual directors. These categorical standards are contained in the Corporate Governance Guidelines, which are availableposted on the corporate governance section of the Company’s corporate website atwww.footlocker.com/corpgovfootlocker.com/corp. You may also obtain a printed copy of the guidelines by writing to the Secretary at the Company’s headquarters.

The Board has adopted chartersdetermined that the following categories of relationships are immaterial for purposes of determining whether a director is independent under the NYSE listing standards:

| Categorical Relationship | Description |

| Investment Relationships with the Company | A director and any family member may own equities or other securities of the Company. |

| Relationships with Other Business Entities | A director and any family member may be a director, employee (other than an executive officer), or beneficial owner of less than 10% of the shares of a business entity with which the Company does business, provided that the aggregate amount involved in a fiscal year does not exceed the greater of $1 million or 2% of either that entity’s or the Company’s annual consolidated gross revenue. |

| Relationships with Not-for-Profit Entities | A director and any family member may be a director or employee (other than an executive officer or the equivalent) of a not-for-profit organization to which the Company (including the Foot Locker Foundation) makes contributions, provided that the aggregate amount of the Company’s contributions in any fiscal year do not exceed the greater of $1 million or 2% of the not-for-profit entity’s total annual receipts. |

We individually inquire of each of our directors and executive officers about any transactions in which the Company and any of these related persons or their immediate family members are participants. We also make inquiries within the Company’s records for information on any of these kinds of transactions. Once we gather the information, we then review all relationships and transactions of which we are aware in which the Company and any of our directors, executive officers, their immediate family members or five-percent shareholders are participants to determine, based on the facts and circumstances, whether the related persons have a direct or indirect material interest. The General Counsel’s office coordinates the related person transaction review process. The Nominating and Governance Committee reviews any reported transactions involving directors and their immediate family members in making its recommendation to the Board on the independence of the directors. In approving, ratifying, or rejecting a related person transaction, the Nominating and Governance Committee considers such

| 2019 Proxy Statement |  13 |

Corporate Governance

information as it deems important to determine whether the transaction is on reasonable and competitive terms and is fair to the Company. The Company’s written policies and procedures for related person transactions are included within both the Corporate Governance Guidelines and the Code of Business Conduct. There were no related person transactions in 2018.

The Board, upon the recommendation of the Nominating and Governance Committee, has determined that the following directors are independent under NYSE rules because they have no material relationship with the Company that would impair their independence:

Jarobin Gilbert, Jr. served as a director of the Company during 2018 until his retirement from the Board in May 2018. The Board determined that Mr. Gilbert was independent under NYSE rules through the end of his term as a director because he had no material relationship with the Company that would impair his independence.

In making its independence determination, the Board reviewed recommendations of the Nominating and Governance Committee and considered Dona D. Young and Ulice Payne, Jr.’s relationships as directors of companies with which we do business. The Board has determined that these relationships meet the categorical standard for Relationships with Other Business Entities and are immaterial with respect to determining independence.

The Board has determined that all members of the Audit Committee, the Compensation Committee, the Finance Committee, and the Nominating Committee. Copies ofand Governance Committee are independent as defined under the charters for these committees are available onNYSE listing standards and the corporate governance section ofdirector independence standards adopted by the Company’s corporate website atwww.footlocker.com/corpgov. You may also obtain printed copies of these charters by writing to the Secretary at the Company’s headquarters.Board.

Policy on Voting for DirectorsBoard Leadership Structure

Our Corporate Governance Guidelines provide that if a nominee for directorBoard evaluates, from time to time as appropriate, whether the same person should serve as Chairman and Chief Executive Officer, or whether the positions should be held by different persons, in an uncontested election receives more votes “withheld” from his or her election than votes “for” election, then the director must offer his or her resignation for consideration by the Nominating Committee. The Nominating Committee will evaluate the resignation, weighinglight of all relevant facts and circumstances and what it considers to be in the best interests of the Company and its shareholders,our shareholders. Since May 2016, the positions of Chairman and make a recommendation to theChief Executive Officer have been held by Richard A. Johnson, with Dona D. Young serving as independent Lead Director. The Board on the action to be taken. For example, the Nominating Committee may recommend (i) accepting the resignation, (ii) maintaining the director but addressing what the Nominating Committee believes to be the underlying cause of the withheld votes, (iii) resolving that the director will not be re-nominated in the future for election, or (iv) rejecting the resignation. When making its determination, the Nominating Committee will consider all factors that it deems relevant, including (i) any stated reasons why shareholders withheld votes from the director, (ii) any alternatives for curing the underlying cause of the withheld votes, (iii) the director’s tenure, (iv) the director’s qualifications, (v) the director’s past and expected future contributions to the Board and to the Company, and (vi) the overall composition of the Board, including whether accepting the resignation would cause the Company to fall below the minimum number of directors required under the Company’s By-Laws or fail to meet any applicable U.S. Securities and Exchange Commission (the “SEC”) or New York Stock Exchange (the “NYSE”) requirements. We will promptly disclose the Board’s decision on whether to accept the director’s resignation, including, if applicable, the reasons for rejecting the offered resignation.has utilized various leadership structures since 2010, as shown below:

At this Annual Meeting, shareholders are being asked to approve an amendment to the By-Laws, which is recommended by the Board, to provide for majority voting for directors in uncontested elections. Please see Page 81 for more information on this proposal.

|  |

| January 2010 | December 2014 | May 2015 | May 2016 |

| Positions combined, with an independent Lead Director | Positions separated, with the former Chairman and Chief Executive Officer serving as Executive Chairman, and an independent director serving as Lead Director | Positions separated, with an independent director serving as Non-Executive Chairman | Positions combined, with an independent Lead Director |

Corporate Governance

The Board believes that, a significant majority of its members should be independent, as determined by the Board based on the criteria established by the NYSE. Each year, the Nominating Committee reviews any relationships between outside directors and the Company that may affect independence. Currently, one of the twelve members of the Board serves as an officer of the Company, and the remaining eleven directors are independent under the criteria established by the NYSE. Please see Pages 16 through 17 for more information regarding director independence.

As a general principle, the Board believes that the periodic rotation of committee assignments on a staggered basis is desirable and provides an opportunity to foster diverse perspective and develop breadth of knowledge within the Board.

The Board believes that whenparticularly because the positions of Chairman and Chief Executive Officer are held by the same person, the appointment of an independent lead director should be appointed.is appropriate.

The Lead Director’s responsibilities include:

14 | Foot Locker, Inc. | |

Corporate Governance

The Board considers the periodic rotation of the Lead Director from time to time, taking into account experience, continuity of leadership, and the best interests of the Company.

Dona D. Young currently serves as the Lead Director. The Board believes that Mrs. Young is well suited to serve as Lead Director, given her business, financial, and governance background, as well as her more than sixteeneighteen years of service on our Board.

|

|

Corporate Governance

Our Board evaluates, from time to time as appropriate, whether the same person should serve as Chairman and Chief Executive Officer, or whether the positions should be bifurcated, in light of all relevant facts and circumstances and what it considers to be in the best interests of the Company and our shareholders. In May 2016, the positions of Chairman and Chief Executive Officer were re-combined and are held by Richard A. Johnson, with Dona D. Young serving as independent Lead Director. The Board has utilized various leadership structures since 2001, as shown below:

The Board believes that, based on the Company’s current facts and circumstances, its Board leadership structure is appropriate.

Executive Sessions of Non-Management Directors

The Board holds regularly scheduled executive sessions of non-management directors in conjunction with each quarterly Board meeting. Dona D. Young, as Lead Director, presides at these executive sessions.

Each year, the Board and its committees conduct self-evaluations. The Nominating Committee oversees the evaluation process and reviews the procedures, which may vary from year to year, in advance of each year’s evaluation process. The self-evaluation process is designed to elicit candid feedback regarding the areas where the Board and its committees could improve their effectiveness. In addition, in a prior year, the Nominating Committee engaged a third party to conduct a survey of the directors with regard to the assessment process and other governance areas and report to the full Board on the survey results and benchmark information, and may consider engaging a third party in the future with regard to the evaluation process.

Board Members’ Attendance at Annual Meetings

Directors are expected to attend annual meetings of shareholders. The annual meeting is normally scheduled on the same day as a quarterly Board meeting. In 2016, all of the directors then serving attended the annual meeting.

Director On-Boarding and Education

We have an on-boarding program for new directors that is intended to educate a new director on the Company and the Board’s practices. OverDuring the coursefirst year of the one-year on-boarding program,director’s service, the newly-elected director meets with the Company’s Chief Executive Officer, Chief Financial Officer, Chief Human Resources Officer, General Counsel and Secretary, and other members of senior management, to review the Company’s business operations, financial matters, strategy, investor relations, risk management, corporate governance, composition of the Board and its committees, and succession and development plans. Additionally, he

|  |

Corporate Governance

or she visits our stores atnear the Company’s New York headquarters, and elsewhere, with senior management for an introduction to store operations. During the on-boardingthis first year, new directors periodically meet with the Lead Director and will meet with the committee chairs for a deep divean immersion into the work of the committees.

The second phase of the on-boarding program commences approximately 18 months after the director joins the Board and is specifically tailored to the individual director, taking into consideration his or her experience as a director of other public companies, the committees of our Board on which he or she serves, and areas of our business and strategy that the director would like to explore more thoroughly with management. For example, during this second phase of the program, directors participate in enhanced discussions in the areas of customer data, retail accounting and operations, and risk management, and meet with key talent. Regular check-ins with the Lead Director continue throughout the on-boarding program.

We also provide the Board with educational training, from time to time on subjects applicable to the Board and the Company, including with regard to retailing, accounting, financial reporting, and corporate governance, using both internal and external resources, in connection with each quarterly Board meeting and weprovide outside speakers on relevant topics during Board dinners. We encourage all directors to attend other continuing education programs to maintain their expertise and provide feedback to the other directors on these programs.

PaymentMandatory Resignation or Retirement

The Board has established a policy whereby a non-employee director is required to advise the Chair of the Nominating and Governance Committee of any change to his or her principal employment. If requested by the Chair, after consultation with the members of the Committee, the director will submit a letter of resignation to the Chair of the Committee, and the Committee would then meet to consider whether to accept or reject the resignation.

The Corporate Governance Guidelines also require that directors retire from the Board at the annual meeting of shareholders following the director’s 72nd birthday.

Corporate Governance Guidelines

The Board has responsibility for establishing broad corporate policies, reviewing significant developments affecting the Company, overseeing the business strategy, and monitoring the general performance of the Company.

The Board has adopted Corporate Governance Guidelines. The Board periodically reviews the guidelines and revises them, as appropriate. The Corporate Governance Guidelines are available on the corporate governance section of the Company’s corporate website atfootlocker.com/corp. You may also obtain a printed copy of the guidelines by writing to the Secretary at the Company’s headquarters.

| 2019 Proxy Statement |  15 |

Corporate Governance

Board Attendance

The Board held six meetings during 2018. All of our directors attended at least 75% of the aggregate of the meetings of the Board and of the committees on which they served in 2018.

The Board holds regularly scheduled executive sessions of non-management directors in conjunction with each Board meeting. Dona D. Young, as Lead Director, presides at these executive sessions.

Directors Feesare expected to attend annual meetings of shareholders. The annual meeting is normally scheduled on the same day as a quarterly Board meeting. In 2018, all of the directors attended the annual meeting.

Retention of Outside Advisors

The Board and all of its committees have authority to retain outside advisors and consultants that they consider necessary or appropriate in carrying out their respective responsibilities. The independent accountants are retained by, and report directly to, the Audit Committee. In addition, the Audit Committee is responsible for overseeing the qualifications, performance, and compensation of the internal auditors to which the Company has outsourced in part. Similarly, the consultant retained by the Compensation Committee to assist in the evaluation of senior executive compensation reports directly to that committee.

Board Evaluations

Each year, the Board and its committees engage in a robust evaluation process consistent with the Board’s goal of continuous improvement. The Nominating and Governance Committee oversees the evaluation process and reviews the procedures, which may vary from year to year, in advance of each year’s evaluation. The process is designed to elicit candid feedback regarding the areas in which the Board and its committees could improve their effectiveness and utilizes surveys, individual interviews, and action planning.

In addition, in 2018, the Board enhanced its evaluation process and undertook a 360-degree peer evaluation process facilitated by an independent third party. Each director completed an evaluation and individual interview with the third party. The Chair of the Nominating and Governance Committee and the Lead Director each received copies of the completed evaluations. The Lead Director met separately with each director, and the Chair of the Nominating and Governance Committee met with the Lead Director, to discuss the results of the individual evaluations. The Board plans to conduct peer evaluations approximately every two to three years.

Stock Ownership Guidelines

The Board has adopted Stock Ownership Guidelines applicable to the Board, the Chief Executive Officer, and other covered executives. The Guidelines are as follows:

| Covered Position | Stock Ownership Guidelines |

| Non-employee Director | 4xAnnual Retainer Fee (both Cash and Equity)

|

| Chief Executive Officer | 6xAnnual Base Salary

|

| Executive Vice President | 3xAnnual Base Salary  |

Senior Vice President; Senior Vice President and General Manager | 2xAnnual Base Salary

|

Corporate Vice President; Vice President and General Manager | 0.5xAnnual Base Salary

|

16 | Foot Locker, Inc. |

Corporate Governance

Shares of unvested restricted stock, unvested restricted stock units (“RSUs”), and deferred stock units (“DSUs”) are counted towards ownership for purposes of the Stock Ownership Guidelines. Performance-based RSUs (“PBRSUs”) are counted once earned. Stock options and shares held through the Foot Locker 401(k) Plan are disregarded in calculating ownership.

Directors, the Chief Executive Officer, and other covered executives are required to be in compliance within five years of becoming subject to these guidelines. In the event of any increase in the required ownership level, whether as a result of an increase in the annual retainer fee or base salary or an increase in the required ownership multiple, the target date for compliance with the increased ownership guideline would be five years after the effective date of such increase.

All executives and directors who were required to be in compliance with the guidelines as of the end of the 2018 fiscal year are in compliance. The Company measures compliance with the guidelines at the end of the prior fiscal year based on the market value of the Company’s stock at that time.

If a director, the Chief Executive Officer, or other covered executive fails to be in compliance with the guidelines as of the end of the prior fiscal year, he or she must hold the net shares obtained through future stock option exercises and restricted stock and RSU vestings, after payment of applicable taxes, until again regaining compliance with the guidelines. In order to take into consideration fluctuations in the Company’s stock price, any person who has been in compliance with the guidelines as of the end of at least one of the two preceding fiscal years and who has not subsequently sold shares will not be subject to this holding requirement. For non-employee directors, the Nominating and Governance Committee will consider a director’s failure to comply with the Stock Ownership Guidelines when considering that director for reelection.

The non-employee directors receive one-half of their annual retainer fees, including committee chair retainer fees, in shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), with the balance payable in cash. Directors may elect to receive up to 100% of their annual retainer fees in stock.

Director RetirementPolitical Contributions

Our Code of Business Conduct prohibits making contributions on behalf of the Company to political parties, political action committees, political candidates, or holders of public office. The Board has establishedCompany is a policymember of several trade associations which, as part of their overall activities, may engage in its Corporate Governance Guidelines that directors retire fromadvocacy activities with regard to issues important to the Board atretail industry or the annual meeting of shareholders following the director’s 72nd birthday.business community generally.

Change in a Director’s Principal Employment

The Board has established a policy whereby a director is required to advise the ChairOur Board’s Oversight of the Nominating Committee of any change to his or her principal employment. If requested by the Chair of the Committee, after consultation with the members of the Committee, the director will submit a letter of resignation to the Chair of the Committee, and the Committee would then meet to consider whether to accept or reject the letter of resignation.Our Business

The Board engages in an effective planning process to identify, evaluate, and select potential successors to the Chief Executive Officer and other members of senior management. The Chief Executive Officer reviews senior management succession planning with the Board. Each director has complete and open access to any member of management. Members of management are invited regularly to make presentations at Board and committee meetings and meet with directors in informal settings to allow the directors to form a more complete understanding of the executives’ skills and character.Risk Oversight

The Board has oversight responsibilities regarding risks that could affect the Company. This oversight is conducted primarily through the Audit Committee.

The Audit Committee has established procedures for reviewing the Company’s risks. These procedures include regular risk monitoring by management to update current risks and identify potential new and emerging risks, quarterly risk reviews by management with the Audit Committee, and an annual risk report to the full Board. In addition, the Audit Committee receives regular briefings from our Chief Information and Customer Connectivity Officer, Chief Financial Officer, Chief Accounting Officer, General Counsel, head of our internal audit function, and outside experts on cybersecurity risks and cyber risk oversight. During these meetings, the Audit Committee and management discuss these risks, risk management activities and efforts, best practices, lessons learned from incidents at other companies, the effectiveness of our security measures, and other related matters. The Audit Committee Chair reports on the committee’s meetings, considerations, and actions to the full Board at the next Board meeting following each committee meeting. In addition, the

The Compensation Committee considers risk in relation to the Company’s compensation policies and practices. The Compensation Committee’s independent compensation consultant provides an annual report to the committee on risk relative to the Company’s compensation programs.

The Company believes that this process for risk oversight is appropriate in light of the Company’s business, size, and active senior management participation, including by the Chief Executive Officer, in managing risk and holding regular discussions on risk with the Audit Committee, the Compensation Committee, and the Board.

|

|

17 |

Corporate Governance

| Cybersecurity |

We are subject to technology risks including failures, security breaches, and cybersecurity risks which could harm our business, damage our reputation, and increase our costs in an effort to protect against such risks. Our cybersecurity program includes the following elements:

| Privacy |

Our Privacy Policy and Privacy Statement govern our treatment of customer data. Our policies provide explanations of the types of customer personal information we collect, how we use and share that information and the measures we take to protect the security of that information. Our policies provide multiple points of contact through which our customers may initiate inquiries and raise concerns to us regarding our collection, sharing, and use of their personal data. Our privacy policies and practices in the European Union were updated in 2018 in response to the EU Global Data Protection Regulation (GDPR) requirements. Our privacy statements and practices in the United States are currently being reviewed in response to the requirements of the California Consumer Privacy Act (CCPA), which is scheduled to come into force in January 2020.

Code of Business Conduct

The Company has adopted a Code of Business Conduct for directors, officers, and other employees, including its Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer. The Company periodically reviews the Code of Business Conduct and revises it, as appropriate. A copy of the Code of Business Conduct is available on the corporate governance section of the Company’s corporate website atfootlocker.com/corp. You may obtain a printed copy of the Code of Business Conduct by writing to the Secretary at the Company’s headquarters.

Any waivers of the Code of Business Conduct for directors and executive officers must be approved by the Audit Committee. The Company promptly discloses amendments to the Code of Business Conduct and any waivers of the Code of Business Conduct for directors and executive officers on the corporate governance section of the Company’s corporate website atfootlocker.com/corp.

Global Sourcing Guidelines

The Company has adopted Global Sourcing Guidelines that set out standards applicable to the production of all products sold in our stores. The Company periodically reviews the guidelines and revises them, as appropriate. The Global Sourcing Guidelines are available on the corporate governance section of the Company’s corporate website atfootlocker.com/corp. You may also obtain a printed copy of the guidelines by writing to the Secretary at the Company’s headquarters.

Succession Planning

The Board has adopted Stock Ownership Guidelines applicableengages in an effective planning process to the Board,identify, evaluate, and select potential successors to the Chief Executive Officer and other covered executives.members of senior management. The GuidelinesChief Executive Officer reviews senior management succession planning with the Board. Each director has complete and open access to any member of management. Members of management, including those several levels below senior management, are as follows:invited regularly to make presentations at Board and committee meetings and meet with directors in informal settings to allow the directors to form a more complete understanding of the executives’ skills and character.

| |

Shares of unvested restricted stock, unvested restricted stock units (“RSUs”), and deferred stock units (“DSUs”) are counted towards beneficial ownership. Performance-based RSUs are counted once earned. Stock options and shares held through the Foot Locker 401(k) Plan are disregarded in calculating beneficial ownership for purposes of the Stock Ownership Guidelines.

Corporate Governance

Non-employee directors

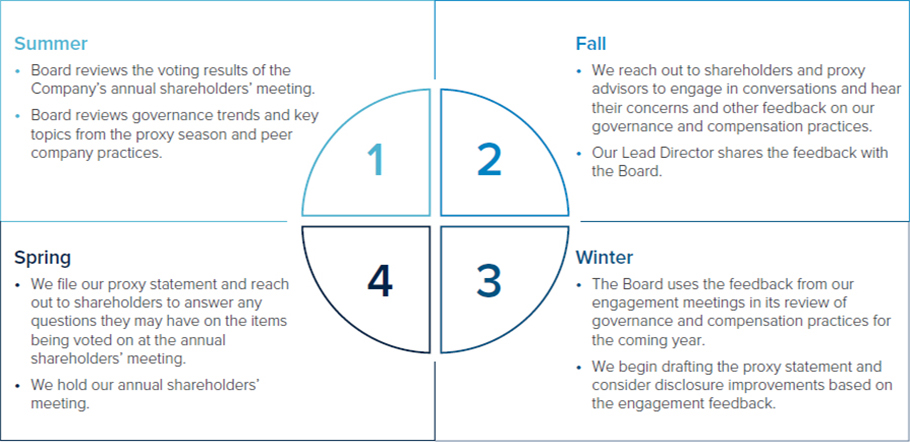

Shareholder Engagement and executives whoVoting

We value our shareholders’ views and insights, which is why last year we extended our proactive shareholder engagement program with a specific focus on corporate governance and compensation. This program complements the ongoing dialogue throughout the year among our shareholders and our Chief Executive Officer, Chief Financial Officer, and Investor Relations team on financial and strategic performance. Our engagement program is designed to reach out to our shareholders and hear their perspectives about issues that are covered byimportant to them, both generally and with regard to the guidelines are required to be in compliance within five years afterCompany, and gather feedback. We believe that this engagement program promotes transparency between the effective date of becoming subject to these guidelines. In the event of any increaseBoard and our shareholders and builds informed and productive relationships.

Beginning in the required ownership level, whetherfall of 2018, our Lead Director and a member of management met individually with seven of our larger shareholders, as well as proxy advisory firms, and discussed topics such as board refreshment and composition, the board evaluation process, boardroom and company culture, executive compensation, and environmental, social, and governance topics. The Lead Director shared the feedback gained from these meetings with the full Board and the Nominating and Governance Committee, as well as compensation-specific feedback with the Compensation Committee, and, as a result of an increasethe feedback, enhancements have been made to this proxy statement to further improve transparency. As reflected in the annual retainer fee or base salary or an increase infollowing engagement cycle, the required ownership multiple, the target date for compliance with the increased ownership guideline would be five years after the effective date of such increase.Company oversees a rigorous and comprehensive shareholder engagement process:

All non-employee directors and executives who were required to be in compliance with the guidelines as of the end of the 2016 fiscal year are in compliance. The Company measures compliance with the guidelines at the end of the prior fiscal year based on the market value of the Company’s stock at that time.

If a directorPlease continue to share your thoughts or covered executive fails to be in compliance with the guidelines as of the end of the prior fiscal year, he or she must hold the net shares obtained through future stock option exercises and the vesting of restricted stock and RSUs, after payment of applicable taxes, until coming into compliance with the guidelines. In order to take into consideration fluctuations in the Company’s stock price,concerns at any person who has been in compliance with the guidelines as of the end of at least one of the two preceding fiscal years and who has not subsequently sold shares will not be subject to this holding requirement. For non-employee directors, the Nominating Committee will consider a director’s failure to comply with the Stock Ownership Guidelines when considering that director for reelection.

Our Code of Business Conduct prohibits making contributions on behalf of the Company to political parties, political action committees, political candidates, or holders of public office. The Company is a member of several trade associations which, as part of their overall activities, may engage in advocacy activities with regard to issues important to the retail industry or the business community generally.

|  |

Corporate Governance

time. The Board has established a procedure forprocess to facilitate communication by shareholders and other interested parties to send communications towith the non-management members ofBoard, described below.

Communications with the Board. Board

Shareholders and other interested parties who wish to communicate directly with the non-management directors of the Company should send a letter to the Board of Directors, c/o Secretary, Foot Locker, Inc., 330 West 34th Street, New York, New York 10001.

The Secretary will promptly send a copy of the communication to the Lead Director, who may direct the Secretary to send a copy of the communication to the other non-management directors and may determine whether a meeting of the non-management directors should be called to review the communication.

A copy of the Procedures for Communications with the Board of Directors is available on the corporate governance section of the Company’s corporate website atwww.footlocker.com/corpgovfootlocker.com/corp. You may obtain a printed copy of the procedures by writing to the Secretary at the Company’s headquarters.

| 2019 Proxy Statement |  19 |

Corporate Governance

Majority Voting in the Election of Outside AdvisorsDirectors

Directors must be elected by a majority of the votes cast in elections for which the number of nominees for election does not exceed the number of directors to be elected. A plurality vote standard applies to contested elections where the number of nominees exceeds the number of directors to be elected. Our Corporate Governance Guidelines provide that any incumbent director who does not receive a majority of the votes cast in an uncontested election is required to tender his or her resignation for consideration by the Nominating and Governance Committee. The BoardNominating and all of its committees have authority to retain outside advisors and consultants that they consider necessary or appropriate in carrying out their respective responsibilities. The independent accountants are retained by, and report directlyGovernance Committee will make a recommendation to the Audit Committee. In addition,Board whether to accept or reject the Committee is responsible for the selection, assessment, and termination of the internal auditors to which the Company has outsourced a portion of its internal audit function, which is ultimately accountable to the Audit Committee. Similarly, the consultant retained by the Compensation Committee to assistresignation, or whether other action should be taken. The director who tenders his or her resignation will not participate in the evaluation of senior executive compensation reports directly to that committee.

The Company has adopted a Code of Business Conduct for directors, officers, and other employees, including its Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer. A copy of the Code of Business Conduct is available on the corporate governance section of the Company’s corporate website atwww.footlocker.com/corpgov. You may obtain a printed copy of the Code of Business Conduct by writing to the Secretary at the Company’s headquarters.

Any waivers of the Code of Business Conduct for directors and executive officers must be approved by the Audit Committee. The Company promptly discloses amendments to the Code of Business Conduct and any waivers of the Code of Business Conduct for directors and executive officers on the corporate governance section of the Company’s corporate website atwww.footlocker.com/corpgov.

We individually inquire of each of our directors and executive officers about any transactions in which the Company and any of these related persons or their immediate family members are participants. We also make inquiries within the Company’s records for information on any of these kinds of transactions. Once we gather the information, we then review all relationships and transactions of which we are aware in which the Company and any of our directors, executive officers, their immediate family members or five-percent shareholders are participants to determine, based on the facts and circumstances, whether the CompanyCommittee’s or the related persons have a direct or indirect material interest. The General Counsel’s office coordinates the related person transaction review process. The Nominating Committee reviews any reported transactions involving directors and their immediate family members in makingBoard’s decision. In determining its recommendation to the Board, on the independenceNominating and Governance Committee will consider all factors that it deems relevant. Following such determination, the Company will promptly disclose publicly the Board’s decision, including, if applicable, the reasons for rejecting the tendered resignation.

Proxy Access

Under our proxy access by-law, a shareholder, or a group of up to 20 shareholders, owning at least 3% of the directors.Company’s outstanding Common Stock continuously for at least three years as of the date of the notice of nomination, may nominate and include in the Company’s proxy materials director nominees constituting up to two individuals or 20% of the Board, whichever is greater (subject to certain limitations set forth in the By-Laws), provided that the shareholder(s) and nominee(s) satisfy the requirements specified in the By-Laws.

Environmental, Social, and Governance Highlights

Foot Locker recognizes the importance of environmental, social, and governance (ESG) issues to shareholders and formed a global cross-functional team, including Legal, Human Resources, Supply Chain, Sourcing, and Real Estate/Construction, among other functions, to monitor our ESG efforts. The Company’s written policiesBoard oversees our ESG program and procedures for related person transactionsreceives regular updates from management.

Foot Locker’s ESG priorities are included within both the Corporate Governance Guidelinescentered onOpportunity;Community;Worker Dignity; and the Code of Business Conduct. There were no related person transactions in 2016.Sustainability.

|  |

|

We aim to create opportunities for all of Directorsour employees.

The Board has responsibility for establishing broad corporate policies, reviewing significant developments affecting the Company,

The Board held five meetings during 2016. All of our directors attended at least 75% of the aggregate of the meetings of the Board are ethnically diverse

| * | U.S. workforce represents 74% of global workforce. |

A director is not considered independent under NYSE rules if he or she has a material relationship with the Company that would impair his or her independence. In addition to the independence criteria established by the NYSE, the Board has adopted categorical standards to assist it in making its independence determinations regarding individual directors. These categorical standards are contained in the Corporate Governance Guidelines, which are posted on the Company’s corporate website atwww.footlocker.com/corpgov.

The Board has determined that the following categories of relationships are immaterial for purposes of determining whether a director is independent under the NYSE listing standards:

| Foot Locker, Inc. |

Corporate Governance

| Fostering Diversity, Inclusion, and Equality | |||